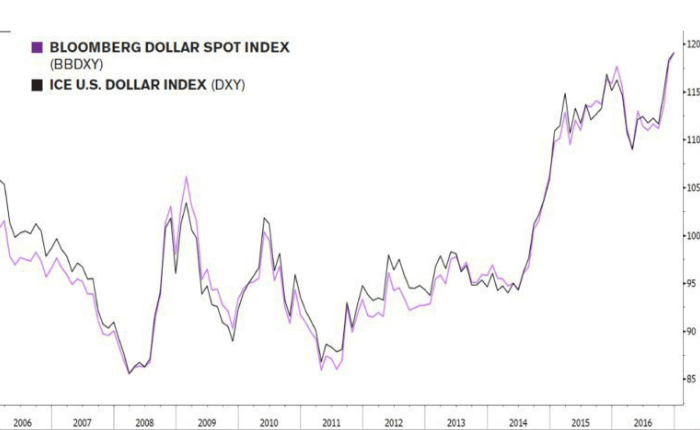

Bloomberg Dollar Spot Index

The Bloomberg Dollar Spot Index (BBDXY) tracks the performance of a basket of 10 global currencies against the U.S. dollar.

Its composition is updated annually and represents a diverse set of important currencies from a global trade and liquidity perspective.

Since other dollar indices (ahem…DXY) do not update their composition and are comprised of only a handful of currencies with concentrated weights, Bloomberg claims their index provides a better measure of the U.S. dollar.

BBDXY is more dynamic.

Unlike the DXY’s static composition, BBDXY is dynamic, with an annual rebalancing process that captures the changing state of currency markets.

This results in the index that includes important currencies (like the Australian dollar) that rank higher in liquidity and trading versus the Swedish krona.