Bond Yields Affect on Currency Movements

A bond is an “IOU” issued by an entity when it needs to borrow money.

These entities, such as governments, municipalities, or multinational companies, need a lot of funds in order to operate so they often need to borrow from banks or individuals like you.

When you own a government bond, in effect, the government has borrowed money from you.

You might be wondering, “Isn’t that the same as owning stocks?”

One major difference is that bonds typically have a defined term to maturity, wherein the owner gets paid back the money he loaned, known as the principal, at a predetermined set date.

Also, when an investor purchases a bond from a company, he gets paid at a specified rate of return, also known as the bond yield, at certain time intervals.

These periodical interest payments are commonly known as coupon payments.

Bond Yield

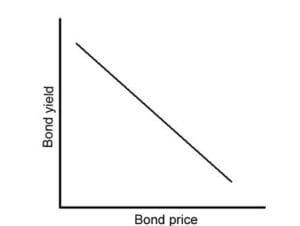

Bond yield refers to the rate of return or interest paid to the bondholder while the bond price is the amount of money the bondholder pays for the bond.

Now, bond prices and bond yields are inversely correlated. When bond prices rise, bond yields fall and vice-versa.

Here’s a simple illustration to help you remember:

Always keep in mind that inter-market relationships govern currency price action.

Bond yields actually serve as an excellent indicator of the strength of a nation’s stock market, which increases the demand for the nation’s currency.

For example, U.S. bond yields gauge the performance of the U.S. stock market, thereby reflecting the demand for the U.S. dollar.

Let’s look at one scenario: Demand for bonds usually increases when investors are concerned about the safety of their stock investments.

This flight to safety drives bond prices higher and, by virtue of their inverse relationship, pushes bond yields down.

Government bond yields act as an indicator of the overall direction of the country’s interest rates and expectations.

For example, in the U.S., you would focus on the 10-year Treasury note.

A rising yield is dollar bullish. A falling yield is dollar bearish.

It’s important to know the underlying dynamic of why a bond’s yield is rising or falling.

It can be based on interest rate expectations OR it can be based on market uncertainty and a “flight to safety” with capital flowing from risky assets like stocks to less risky assets like bonds.

Bond Spreads Between Two Countries Affect Their Exchange Rate

The bond spread represents the difference between two countries’ bond yields.

These differences give rise to carry trade. As the bond spread between the two economies widens, the currency of the country with the higher bond yield appreciates against the other currency of the country with the lower bond yield. By monitoring bond spreads and expectations for interest rate changes, you will have an idea of where currency pairs are headed.

Fixed Income Securities Affect Currency Movements

As the bond spread or interest rate differential between two economies increases, the currency with the higher bond yield or interest rate generally appreciates against the other.

Fixed-income securities (including bonds) are investments that offer a fixed payment at regular time intervals.

Economies that offer higher returns on their fixed-income securities should attract more investments.

This would then make their local currency more attractive than those of other economies offering lower returns on their fixed-income market.

Here are some of the popular bonds from around the globe and their names