Currency Correlation.

The first half was easy. Currency. No explanation is needed. The second half. Still easy. Correlation: a relationship between two things.

The first half was easy. Currency. No explanation is needed. The second half. Still easy. Correlation: a relationship between two things.

What is Currency Correlation?

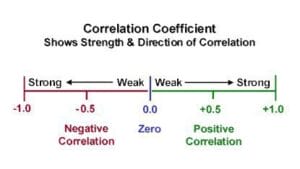

In the financial world, correlation is a statistical measure of how two securities move in relation to each other. Currency correlation, then, tells us whether two currency pairs move in the same, opposite, or totally random direction, over some period of time. When trading currencies, it’s important to remember that since currencies are traded in pairs, no single currency pair is ever totally isolated. (Did we confuse you with our “currencies” tongue-twister sentence there?). Unless you plan on trading just one pair at a time, you must understand how different currency pairs move in relation to each other. Correlation is computed into what is known as the correlation coefficient, which ranges between -1 and +1. A perfect positive correlation (a correlation coefficient of +1) implies that the two currency pairs will move in the same direction 100% of the time. A perfect negative correlation (a correlation coefficient of -1) means that the two currency pairs will move in the opposite direction 100% of the time. If the correlation is 0, the movements between two currency pairs are said to have ZERO or NO correlation, they are completely independent and random from each other. We have no idea how one pair will move in relation to the other.

Correlation Coefficient

Correlation is computed into what is known as the correlation coefficient, which ranges between -1 and +1. A perfect positive correlation (a correlation coefficient of +1) implies that the two currency pairs will move in the same direction 100% of the time. A perfect negative correlation (a correlation coefficient of -1) means that the two currency pairs will move in the opposite direction 100% of the time. If the correlation is 0, the movements between two currency pairs are said to have uh ZERO or NO correlation, they are completely independent and random from each other. We have no idea how one pair will move in relation to the other.

Correlation is computed into what is known as the correlation coefficient, which ranges between -1 and +1. A perfect positive correlation (a correlation coefficient of +1) implies that the two currency pairs will move in the same direction 100% of the time. A perfect negative correlation (a correlation coefficient of -1) means that the two currency pairs will move in the opposite direction 100% of the time. If the correlation is 0, the movements between two currency pairs are said to have uh ZERO or NO correlation, they are completely independent and random from each other. We have no idea how one pair will move in relation to the other.