The Dollar Smile Theory

There are two “types” of U.S. dollars.

There is a “domestic” U.S. dollar which behaves like any other currency. It’s linked to the economy’s relative outlook and potential investment returns.

There is also an “international” U.S. dollar that is used as the primary currency used in global trade (for payments) and is also needed to buy U.S. government bonds which are coveted for their safety.

This “international” U.S. dollar strengthens for a variety of reasons when markets are volatile and global growth slows.

When there is some sort of “shock” that happens, whether from the U.S. or abroad, and it’s big enough to cause investors and traders to panic and send financial markets lower, then it will likely cause the broad U.S. dollar to appreciate.

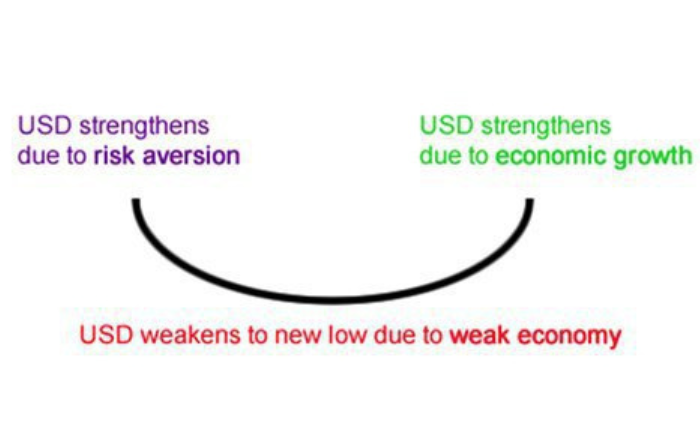

USD Strengthens Due to Risk Aversion

The first part of the smile shows the U.S. dollar benefiting from risk aversion, which causes investors to flee to “safe haven” currencies like the U.S. dollar and the Japanese yen.

Since investors think that the global economic situation is shaky, they are hesitant to pursue risky assets and would rather buy up “safer” assets like U.S. government debt (“U.S. Treasuries”) regardless of the condition of the U.S. economy.

In order to buy U.S. Treasuries though, you need USD, so this increased demand for USD (to buy U.S. Treasuries) causes the U.S. dollar to strengthen.

USD Weakens to New Low Due to Weak Economy

The dollar drops to a new low.

The bottom part of the smile reflects the lackluster performance of the Greenback as the U.S. economy grapples with weak economic fundamentals.

The possibility of interest rate cuts also weighs the U.S. dollar down. (Although if other countries are also expected to cut interest rates, then this might be less of a factor since it’s all about expectations of the future direction of interest rest differentials.)

This leads to the market shying away from the dollar. The motto for USD becomes “Sell! Sell! Sell!”

Another factor is the relative economic performance between the U.S. and other countries. The U.S. economy may not necessarily be horrible, but if its economic growth is weaker than in other countries, then investors will prefer to sell their U.S. dollars and buy the currency of a country with a stronger economy.

USD Strengthens Due to Economic Growth

Dollar bull market. The dollar appreciates due to economic growth.

Lastly, a smile begins to form as the U.S. economy sees the light at the end of the tunnel.

As optimism picks up and signs of economic recovery appear, sentiment toward the dollar begins to pick up.

In other words, the Greenback begins to appreciate as the U.S. economy enjoys stronger GDP growth, and expectations of interest rate hikes increase (relative to other countries).

Dollar Smile Theory in reality

The key is relative economic growth. If growth from other countries is growing, but the U.S. economy is growing even faster, then the U.S. dollar will swing upward to the right

In any case, this is an important theory to keep in mind. Remember, all economies are cyclical. They strengthen, then they weaken, they strengthen, then they weaken and repeat.

The key part is determining which part of the cycle the U.S. economy and then comparing how it’s doing against the rest of the world (RoW).