The Gartley Pattern

The Gartley pattern includes the basic ABCD pattern we’ve already discussed but is preceded by a significant high or low. These patterns usually form when the overall trend is corrected and looks like ‘M’ (or ‘W’ for bearish patterns). These patterns help traders find good entry points for the overall trend. A Gartley form is when the price action has been going on a recent uptrend (or downtrend) but has started to show signs of a correction.

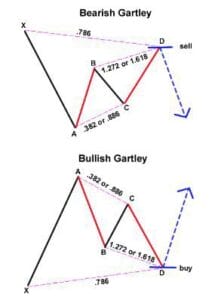

What makes the Gartley such a nice setup when it forms is the reversal points are a Fibonacci retracement and Fibonacci extension level. This gives a stronger indication that the pair may reverse. This pattern can be hard to spot, and once you do, it can get confusing when you pop up all those Fibonacci tools. The key to avoiding all the confusion is to take things one step at a time. In any case, the pattern contains a bullish or bearish ABCD pattern. Still, it is preceded by a point (X) beyond point D.

The “perfect” Gartley pattern has the following characteristics: 1. Move AB should be the .618 retracement of move XA. 2. Move BC should be either .382 or .886 retracement of move AB. 3. If the retracement of move BC is .382 of move AB, then CD should be 1.272 of move BC. Consequently, if move BC is .886 of move AB, CD should extend 1.618 of move BC. 4. Move CD should be .786 retracement of move XA.