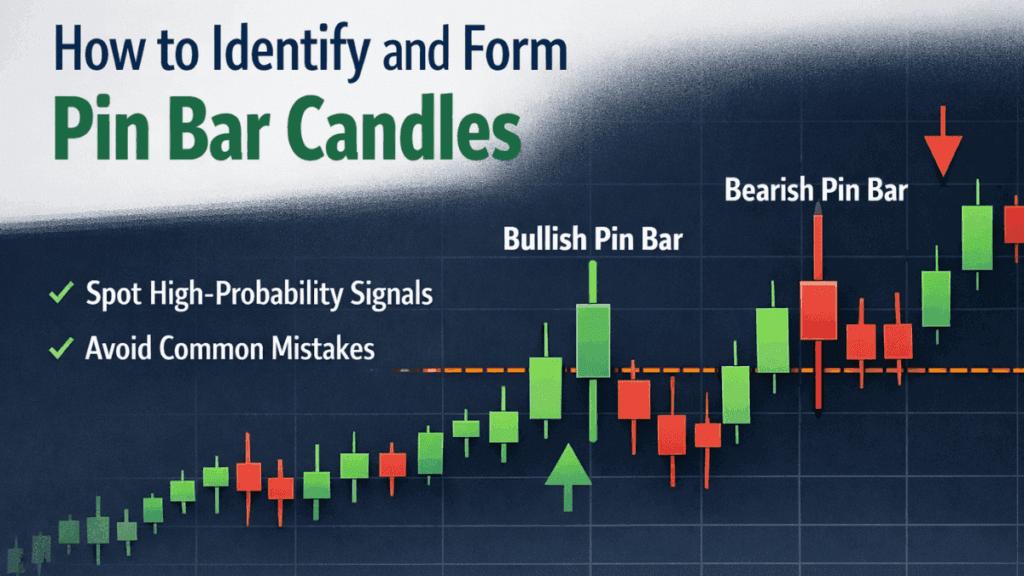

Understanding how to identify and form pin bar candles is a core skill for traders who rely on price action rather than lagging indicators. In its simplest form, a pin bar candle shows rejection of a price level, revealing where buyers or sellers attempted to take control but failed. This makes pin bars one of the clearest ways to read market intent directly from the chart.

Pin bars appear across all financial markets, including forex, stocks, indices, and cryptocurrencies. When properly identified and traded in the right context, they can offer high-probability trade setups with clearly defined risk.

What a Pin Bar Candle Really Represents

A pin bar candle represents a strong rejection of price within a single trading period. It shows that the market explored one direction aggressively but was pushed back before the candle closed.

This behavior reflects a battle between buyers and sellers, where one side clearly overpowered the other by the close. The long wick highlights the rejected prices, while the small body shows where the market finally settled.

Key Structural Features of a Valid Pin Bar

A pin bar is not defined by appearance alone but by specific structural rules. These rules help filter out weak candles that look similar but lack meaning.

A valid pin bar must show clear imbalance and rejection, not just random price movement. Without these elements, the candle has little trading value.

The Long Wick (Tail)

The most important feature of a pin bar is its long wick. This wick should be significantly longer than the candle body and clearly stand out from surrounding candles.

The wick shows where price was strongly rejected. In a bullish pin bar, the lower wick shows sellers failed; in a bearish pin bar, the upper wick shows buyers failed.

The Small Real Body

The real body of a pin bar should be small and positioned near one end of the candle. This placement confirms that price closed far away from the rejected area.

A large body weakens the pin bar’s message because it suggests less rejection and more balanced trading during the period.

Minimal or No Opposite Wick

A strong pin bar usually has little to no wick on the opposite side of the long tail. This shows decisive control by one side of the market.

When both wicks are long, the candle reflects indecision rather than rejection, making it unreliable as a pin bar signal.

Bullish vs Bearish Pin Bar Candles

Pin bars can signal both potential reversals and continuations, depending on their direction and location. Understanding the difference between bullish and bearish pin bars is essential for correct interpretation.

The candle’s wick direction tells you which side of the market failed.

Bullish Pin Bar

A bullish pin bar has a long lower wick and a small body near the top of the candle. This structure shows that sellers pushed price lower but buyers stepped in strongly and forced a higher close.

Bullish pin bars are most effective when they appear at support levels, demand zones, or during pullbacks in an uptrend.

Bearish Pin Bar

A bearish pin bar has a long upper wick with a small body near the bottom. This shows buyers attempted to push price higher but were overpowered by sellers before the close.

Bearish pin bars work best at resistance levels, supply zones, or during pullbacks in a downtrend.

How to Identify High-Quality Pin Bar Setups

Not all pin bars deserve your attention. The strongest pin bar setups appear in logical market locations and align with broader price structure.

Focusing on context prevents overtrading and reduces false signals.

Location Matters More Than the Candle

A pin bar at a random price level carries little meaning. A pin bar at a clear support or resistance level tells a much stronger story.

The market respects historical levels where price has previously reacted. A pin bar at these zones confirms that traders are defending those areas again.

Trend Alignment Increases Reliability

Pin bars that form in the direction of the dominant trend tend to perform better. In an uptrend, bullish pin bars during pullbacks are generally more reliable than bearish ones.

Trading against the trend using pin bars requires stronger confirmation and stricter risk control.

Timeframe Significance

Higher timeframes produce more reliable pin bars because they represent more market participation. A daily pin bar reflects stronger conviction than a five-minute pin bar.

Lower timeframes can still be traded, but they require faster decision-making and tighter risk management.

How to Form a Pin Bar Candle Correctly

Understanding how pin bars form helps you avoid premature entries. A pin bar is only valid once the candle has fully closed.

During formation, price may look like a pin bar but later change shape entirely. Waiting for confirmation protects you from false setups.

A pin bar forms when:

- Price strongly moves in one direction

- That move is aggressively rejected

- The candle closes near the opposite end

This sequence shows that one side tested control and failed decisively.

Common Mistakes When Trading Pin Bar Candles

Many traders struggle with pin bars not because the pattern fails, but because of poor execution. Avoiding these mistakes can significantly improve results.

Misidentifying pin bars or forcing trades where none exist leads to unnecessary losses.

Trading Every Pin Bar You See

Charts naturally produce many pin-like candles. Trading all of them ignores context and increases exposure to noise.

Quality pin bars are rare and stand out clearly from surrounding price action.

Ignoring Support and Resistance

A pin bar without a meaningful level is often just random volatility. Without a clear reason for rejection, the candle has little predictive value.

Always identify the level first, then look for the pin bar as confirmation.

Entering Before Candle Close

Entering while a candle is still forming is a common and costly error. The market can reverse before close, invalidating the setup.

Waiting for the candle to close ensures the rejection is real, not temporary.

Using Pin Bars in a Complete Trading Plan

Pin bars work best as part of a structured trading approach. They should confirm a trade idea, not replace analysis entirely.

Combining pin bars with market structure, trend direction, and risk management creates consistency over time.

Always define your entry, stop loss, and profit target before placing a trade. Pin bars make this easier because the wick provides a natural level for risk placement.

Final Thoughts on Pin Bar Candles

Learning how to identify and form pin bar candles is a powerful step toward mastering price action trading. Pin bars reveal market psychology in its purest form, showing where traders were trapped and forced to exit.

When traded with patience, context, and discipline, pin bars can become one of the most reliable tools in your trading arsenal. Focus on quality over quantity, and let the market clearly show its hand before you act.

Our Editorial Desk – Focuses on forex trading, gold (XAU/USD), and commodities that move the markets. Our editorial desk blends human insight with AI-powered research to produce sharp, actionable content. We aim to help traders make informed decisions with unbiased market coverage.